PCI DSS Compliance Overview (Arryved Pay)

What Is PCI DSS Compliance?

Prerequisites

The info in this guide is exclusive to merchants processing on Arryved Pay.

Limitations

If you fail to become compliant, you’re charged an additional monthly fee until you pass compliance.

Questions and concerns about PCI Compliance are to be handled by the SecurityMetrics support contact provided in your welcome email or this guide. The Arryved Support Team has little power in assisting with PCI Compliance.

How It Works

Everything Is In The Welcome Email!

7-10 days after your first transaction on Arryved Pay, you’ll receive a welcome email from our PCI DSS partner, SecurityMetrics that’ll include:

A link to the PCI DSS portal with login instructions.

Instructions to complete your PCI DSS compliance.

A contact to reach out to with any questions or concerns.

Look for the Subject: [Your Brand] PCI Enrollment for [Your Company Name].

- Here's some additional information about the PCI DSS Compliance Program from SecurityMetrics, your PCI partner.

Shopping Cart Monitor

As of March 31, 2025, PCI DSS V4 has a new requirement for merchants using Ecommerce. This new requirement is standard across the industry and affects all Ecommerce merchants using any Point-of-Sale software.

Arryved has integrated this new requirement in its Ecommerce POS channels, and our PCI partner, Security Metrics, has added a new tool to your compliance package to help you become compliant.

Here’s what you need to do:

- Look out for an email from Security Metrics with the subject "New PCI DSS Compliance Ecommerce Requirements”. (This may be part of your welcome email if you’re a brand-new customer with Security Metrics).

- Open the Shopping Card Monitor link and follow the instructions. The email tells you to check your To-do List in your Security Metrics Portal.

What the Shopping Cart Monitor does:

Once the steps in the Shopping Cart Monitor tool are completed successfully, you’ll be compliant in these two new areas:

- Authorized Script Inventory (PCI Requirement 6.4.3). Maintains an up-to-date inventory of all authorized scripts running on your payment pages. This helps prevent malicious code from compromising your checkout experience.

- JavaScript Skimming Detection (PCI Requirement 11.6.1). Implements a detection mechanism to alert you if a script or third-party iframe payment page is altered—this is how hackers skim cardholder data.

You don’t need to implement the above requirements manually; the Shopping Cart Monitor does it for you! So long as you complete the steps successfully. Reach out to Security Metrics directly if you get stuck.

Not Getting A Welcome Email?

- ArryvedPay.[YourCompanyName].[UniqueNumber].

Here's how to retrieve it:

Option 1: From MerchantTrack

- Log into your MerchantTrack from the left side navigation of your Arryved Portal.

- In MerchantTrack, click on your name in the upper right corner.

- Then click Profile.

- Scroll down to the 'User Merchants' section to find your MID. It will look like this: ArryvedPay.[YourCompanyName].[UniqueNumber]. Ignore the location name to the right of the MID.

Option 2: From Company Settings In Your Arryved Portal

- Log into your Arryved Portal as a Super Admin.

- From the left side navigation, click Company Settings.

- Click Configuration.

- From the company configuration page, click on one of your Company Locations (you may only have one).

- Under your 'Payment Processors' list, look for a column labeled 'Connection Id', your Arryved Pay MID will be in this column next to any agent that says 'FULLSTEAM'

Heads up!

- Check out the SecurityMetrics PCI Compliance FAQ for more info about what's included versus what's optional for an extra cost.

Finding your IP Address

Getting Stuck On These Questions?

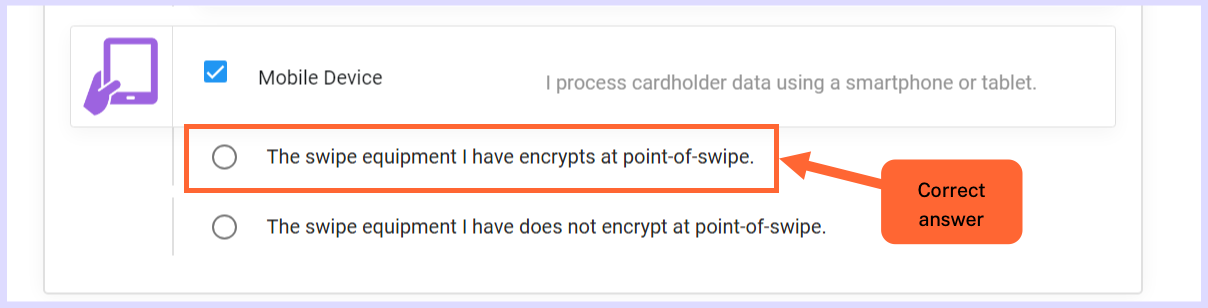

Question: Mobile Device: I process cardholder data using a smartphone or tablet.

Answer: The swipe equipment I have encrypts at point-of-swipe.

Need Assistance?

If you have any questions, concerns, or need assistance, use one of the support contacts below:

1. Administrative questions

Examples

- “What are my monthly PCI fees?”

- “How do I enroll a merchant in SecurityMetrics?”

2. Technical PCI-compliance questions

Examples

- “Which SAQ does my merchant need to complete?”

- “A vulnerability scan failed. How do we resolve it?”

- “What steps are required to become compliant?

Arryved provides access to SecurityMetrics for PCI compliance support but is not legally authorized to certify compliance or complete SAQs on behalf of merchants. Additionally, we cannot provide guidance or make statements that could be interpreted as PCI compliance advice. To avoid any potential liability, please direct all PCI-related questions or concerns to SecurityMetrics.

Next

Please complete your compliance by the deadline provided to avoid a higher monthly fee. Reach out to the Compliance Team with any questions or concerns. Their contact info can be found in your welcome email.

Related Articles

Arryved Pay Fee Structure

What Is My Arryved Pay Fee Structure? At Arryved, we want to be transparent with you. You may be wondering what fees you’re being charged and why. This guide breaks down the additional fees you may see on your MerchantTrack statements. These fees are ...Arryved Pay FAQs

Arryved Pay FAQs What is Arryved Pay? Arryved Pay is our new, end-to-end, complete payment solution. With Arryved Pay, you’ll enjoy access to best-in-class hardware, streamlined payment gateway and processing, cutting-edge payment capabilities, ...Chargeback Overview (Arryved Pay)

What Are Chargebacks? A chargeback is a sale being disputed by a cardholder who transacted at your establishment. When the chargeback is initiated, the card issuer (Visa, Mastercard, etc.) removes the value of the transaction in dispute, from your ...Arryved Insider Overview (For Merchants)

What Is Arryved Insider? Arryved Insider isn’t just a loyalty program, it’s so much more! It’s your solution for driving traffic, engaging guests, and building loyalty in your community. Integrated with your Arryved POS, Insider provides flexibility ...Arryved Pay ACH Deposit FAQs

Arryved Pay ACH Deposit FAQs What Is An ACH Deposit? ACH, or the Automated Clearing House network, is how money is sent electronically from one bank to another. Money routes from your guests’ bank accounts to your business account via ACH deposits ...